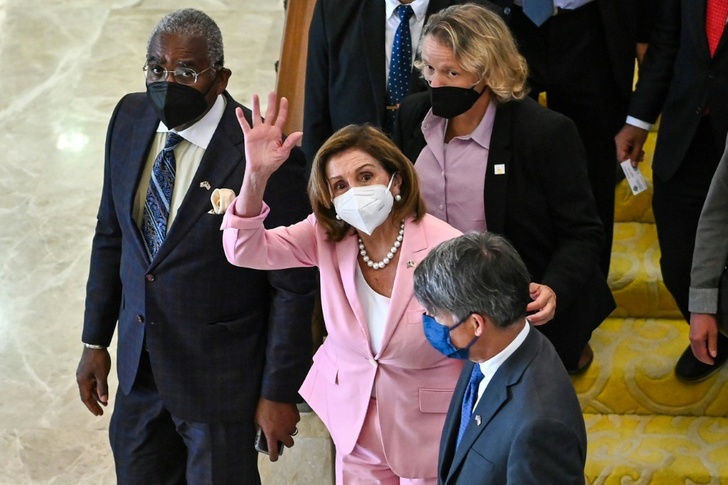

Asian markets mostly rose Wednesday after the previous day's reverse, with focus on House Speaker Nancy Pelosi's visit to Taiwan, which has further strained already tense China-US ties and raised concerns about the long-term impact on the global outlook.

The highest profile trip to the island in 25 years by a US politician was met with condemnation from Beijing, which warned of serious economic and military consequences.

Taiwan said more than 20 Chinese military aircraft had flown into the island's air defence identification zone -- an area wider than its territorial airspace that overlaps with part of China's air defence zone. The People's Liberation Army was also due to conduct a series of drills.

Beijing views the self-ruled island as part of its territory to be seized by force if necessary.

No one expected it would spark a conflict, but the crisis sent shivers through trading floors that were already on edge over a range of issues including the Ukraine war, surging inflation, rising interest rates and slowing economic growth.

However, ahead of a meeting between Pelosi and Taiwan President Tsai Ing-wen most markets saw a recovery, with Hong Kong and Shanghai among the best gainers.

Tokyo, Singapore, Seoul, Wellington and Manila were also up, though Taipei, Sydney and Jakarta edged down.

The "short-term implication may be 'sell the rumour, buy the news' as the official response so far remains much more restrained versus what the market has feared," Xiadong Bao, at Edmond de Rothschild Asset Management, said.

"But the mid/long-term implication can be more significant, which may be currently overlooked by the market. The official return of the US influence in Asia-Pacific will inevitably accelerate US-China decoupling."

Analysts are also keen to find out what the White House's response will be, particularly ahead of mid-term elections in November with anti-China rhetoric playing well with voters, but with President Joe Biden keen not to further harm economic ties.

SPI Asset Management's Stephen Innes added that the US administration was probably not likely to cut Trump-era tariffs before then.

The positive start to the day in Asia followed a drop on Wall Street, where the Taiwan crisis was compounded by a series of hawkish comments from Federal Reserve officials indicating more big interest rate hikes could still be in the pipeline.

Stocks rallied last week and Treasury yields dropped after boss Jerome Powell hinted the bank could begin slowing down, but the latest remarks suggest a hoped-for dovish pivot might not be coming just yet as inflation remains stubbornly high.

The latest developments have raised concerns that the volatility on markets would likely continue for some time.

"It's hard to see any meaningful upside in equities right now," said Xi Qiao, of UBS Group. "The market is going to trade pretty mixed, stay choppy until we have a little bit more certainty," she told Bloomberg News.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.5 percent at 27,740.97 (break)

Hong Kong - Hang Seng Index: UP 0.9 percent at 19,864.26

Shanghai - Composite: UP 0.6 percent at 3,204.47

Taipei - TAIEX: DOWN 0.1 percent at 14,732.65

Dollar/yen: UP at 133.54 yen from 133.10 yen Tuesday

Euro/dollar: UP at $1.0174 from $1.0168

Pound/dollar: UP at $1.2165 from $1.2163

Euro/pound: UP at 83.64 pence from 83.57 pence

West Texas Intermediate: UP 0.1 percent at $94.50 per barrel

Brent North Sea crude: FLAT at $100.54 per barrel

New York - Dow: DOWN 1.2 percent at 32,396.17 (close)

London - FTSE 100: DOWN 0.1 percent at 7,409.11 (close)

dan/mtp

© Agence France-Presse

Your content is great. However, if any of the content contained herein violates any rights of yours, including those of copyright, please contact us immediately by e-mail at media[@]kissrpr.com.

Source: Story.KISSPR.com