Flushing, Mi - 3/25/23 - Despite the prominence of the program, many businesses don't realize they can still apply for the Employee Retention Tax Credit (ERTC) in 2023, even if they received PPP funds prior. This tax credit provides relief to businesses that have faced financial difficulties during the pandemic and continued to pay W2 employees in 2020-2021. The ERTC is a valuable resource that businesses should consider taking advantage of as they move forward into a post-pandemic world.

The ERTC is available to businesses that have experienced a significant decline in gross receipts or have been forced to shut down operations entirely due to the pandemic. It is also available to businesses that have had to reduce employee hours or wages due to the pandemic. The credit amount can be as much as $26,000 per W2 employee, and can be claimed for up to five quarters of eligible wages.

To be eligible for the ERTC, businesses must meet certain criteria, such as having 500 or fewer employees. The credit can be claimed on eligible wages paid from January 1, 2021, through September 30, 2021.

“Businesses have faced unprecedented challenges over the past two years,” said Mike Arthur, Public Relations Manager of MyRefund.net. “The ERTC is a valuable tool for businesses to retain employees and stay afloat during these difficult times. We encourage all eligible businesses to apply for this tax credit in 2023.”

To apply for the ERTC, businesses can work with the tax professionals at MyRefund.net to determine eligibility and calculate the credit amount. Applications for the ERTC can be filed with the IRS on quarterly employment tax returns.

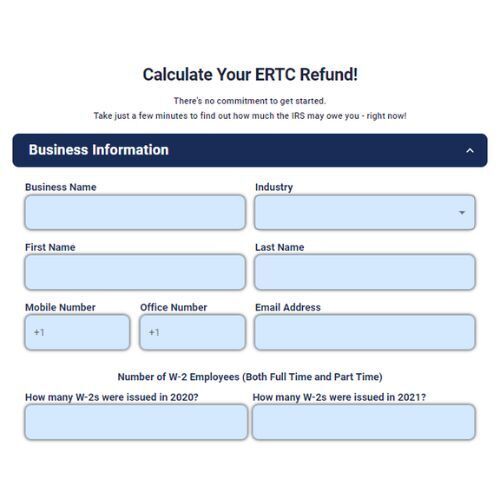

For more information about the Employee Retention Tax Credit, visit the IRS website or fill out the ERTC Credit Calculator found at https://myrefund.net :

About MyRefund.net

MyRefund.net is a consumer friendly portal that puts businesses directly in touch with the top accounting professionals in the nation for ERTC claims. We are dedicated to helping businesses navigate the challenges of the pandemic and beyond by providing valuable resources and expertise.

Contact:

Mike Arthur

MyRefund.net

810-964-3316

https://myrefund.net

Source: Story.KISSPR.com

Release ID: 563834