August 15, 2019 / -- Ferrari is the world’s leading luxury automobile brand. The Italian luxury sports car brand was founded by Enzo Ferrari in 1939 and privately owned by the Ferrari family for a long time. Ferrari is a small company compared to other players in the market —General Motors, Ford, Volkswagen, and Fiat are all much larger. On the other hand, Ferrari isn’t like other automakers.

Ferrari Profit Rises, Raises Cash Flow Outlook

As per Max BERNHARD source

“Ferrari NV RACE, +0.97% said Friday that its net profit rose in the second quarter on the back of sales of its Portofino and 812 Superfast models and raised its guidance for free industrial cash flow.

Net profit in the quarter was 184 million euros ($203.4 million) compared with EUR160 million a year earlier, the Italian sports-car maker said. Revenue rose 9% to EUR984 million.

Earnings before interest and taxes rose 9% to EUR239 million.

The company continues to expect 2019 revenue of at least EUR3.5 billion. Adjusted earnings before interest, taxes, depreciation and amortization are forecast to be between EUR1.2 billion and EUR1.25 billion this year, Ferrari said.

Ferrari raised its expectations for industrial free cash flow for the year, now forecasting more than EUR550 million, compared with about EUR450 million previously.”

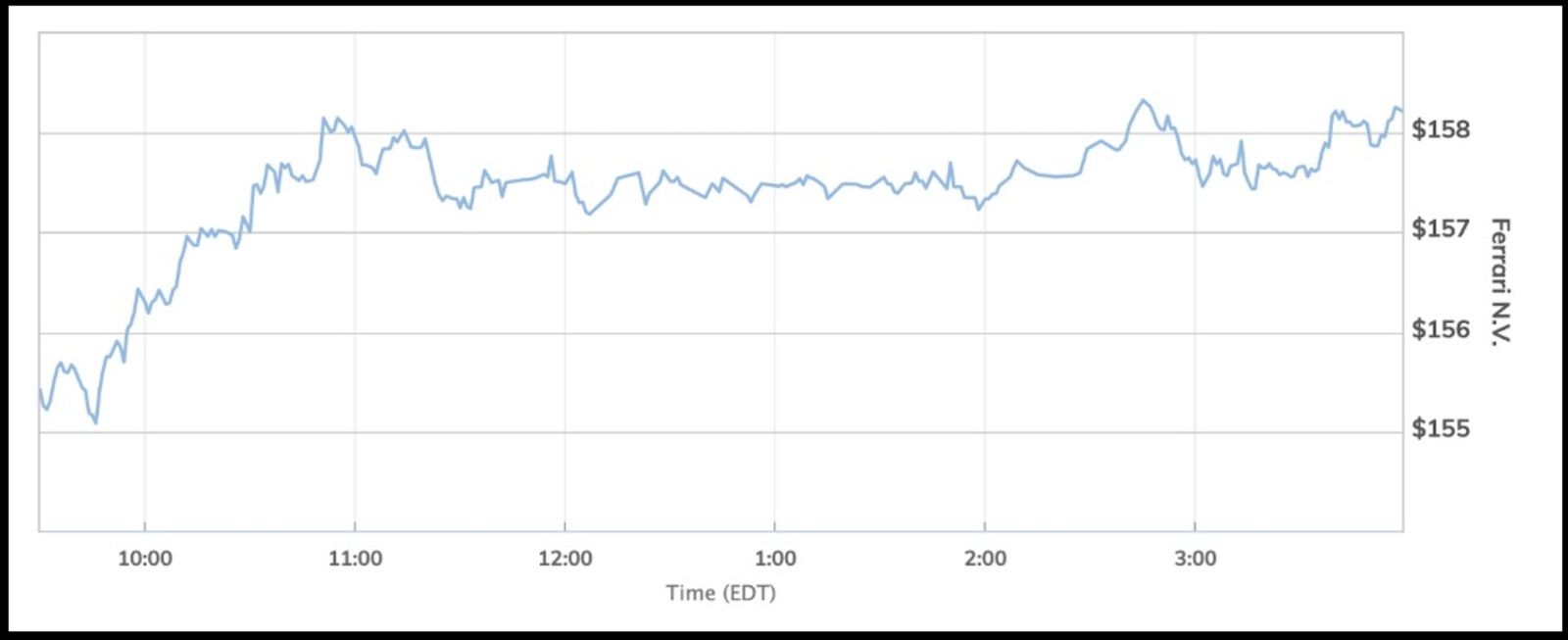

Ferrari’s stocks are trading for 35 times estimated 2020 earnings whereas [As per Al Root; Source], names like GM and F trade with single-digit P/E ratios and have dividend yields in excess of 4% [As per Bret Kenwel; Source].

Ferrari stocks are not trading like other stocks either. The stock has shot up nearly 60% year-to-date and has returned an average of 51% a year over the past 3 years. Conversely, automotive stocks have trailed far behind, climbing only 3.5% year-to-date and just 1.8% a year over the past 3 years [As per Al Root; Source].

Ferrari Zooms Ahead

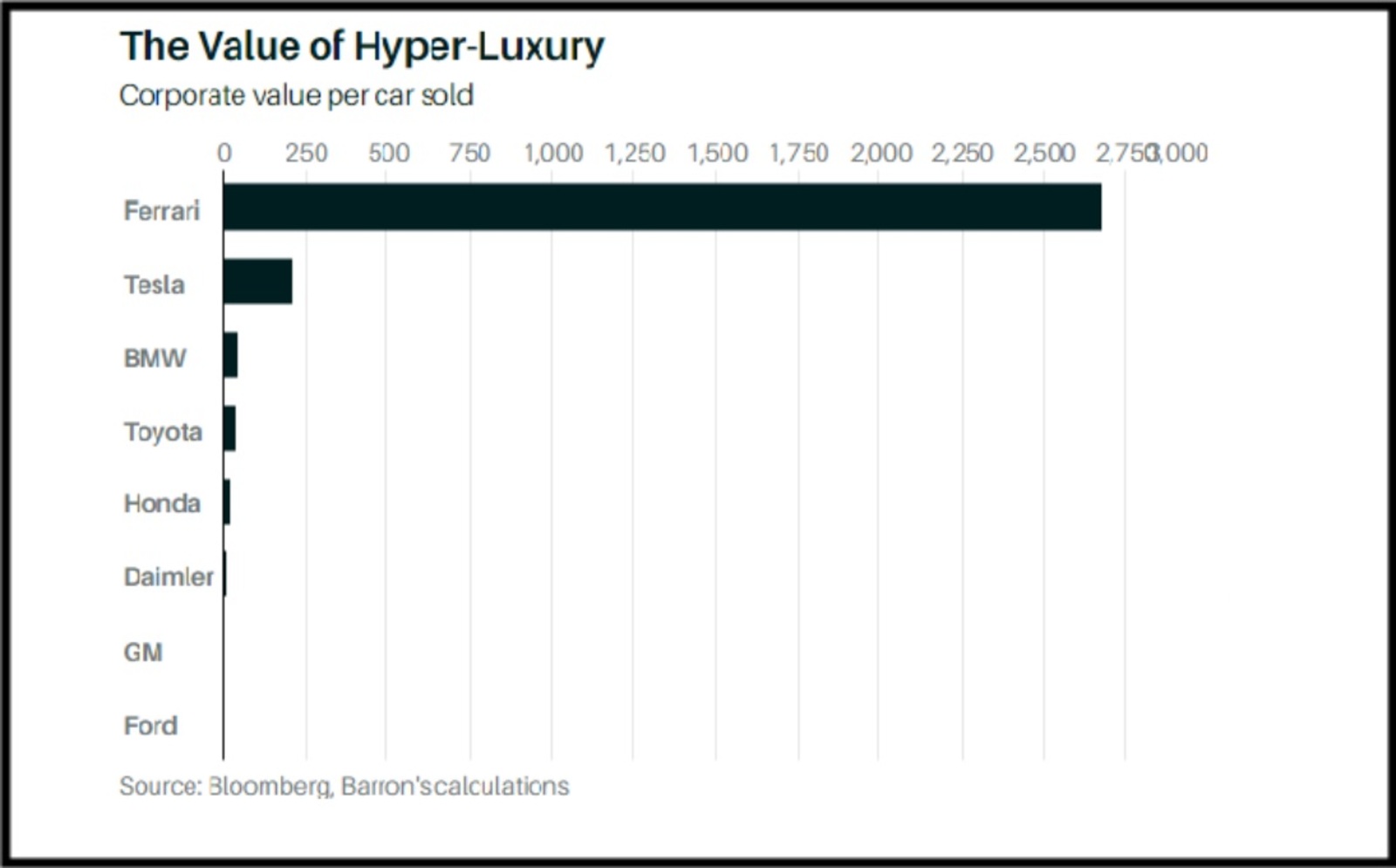

Ferrari has been able to create a league of its own. In terms of corporate value of the cars sold or gross margins, it leaves other luxury brands like Tesla trailing far behind. Below is a chart comparing Ferrari’s corporate value to the entire auto industry:

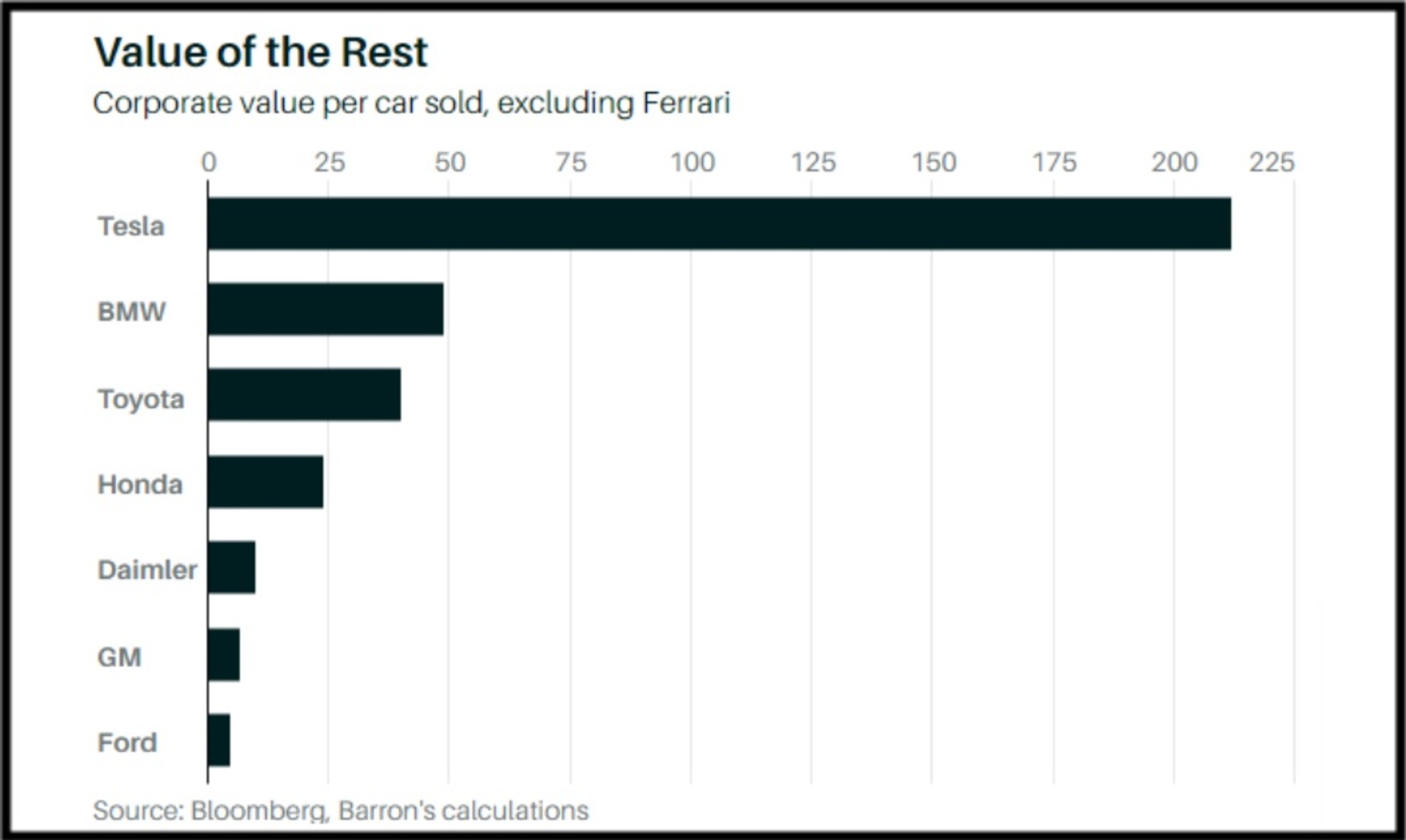

As displayed, Ferrari’s corporate value is miles ahead of other luxury brands including Tesla and others in the auto industry. Here is how the auto industry looks without Ferrari:

Ferrari Is More Than a Luxury Car Brand

Ferrari is able to command such high value for its stock because people perceive and experience it as more than just a car. The company assimilated its legendary status partially on the race tracks, but part of its reputation also comes from the celebrity connection the brand itself fosters.

Ferrari is not just viewed as a luxury car brand but as an elite status symbol. The car maker, by certain measures, is worth more than 580 times Ford and more than 12 times Tesla, another greatly valued luxury automaker. Ferrari continues to draw its allure from four key characteristics.

- Styling: A Ferrari is very much like a piece of art. It is an aesthetically designed, beautiful object that is even appealing to a non-car lover.

- Speed: Speed is arguably the most alluring factor of a Ferrari. There is no chance you can test the upper limits of the car's engine capacity.

- Story: A good story always forges a bond with customers and Ferrari comes with a story that is inspired from its celebrity connections than its speed exploits.

- Scarcity: Despite the above points, Ferrari would be just another luxury car if everyone had one. The limited availability commands the prices that it does, both as a new car and in its used versions.

Ferrari’s Margins

What really distinguishes Ferrari within the luxury car segment itself is the limited number of cars they manufacture and the limited number of cars that are available for sale. As per Jared Rosenholtz, “In 2018, Ferrari just sold 8,400 vehicles and so far in 2019 they have sold 2,610 cars.” The Italian automaker believes in and enjoys the benefits of pursuing their own market strategy—selling a limited number of ultra high-end products to the super rich.

Ferrari’s gross profit margin is much like a luxury goods maker and it is expected to improve with the introduction of new hybrid-electric models that will retail for about $450,000 [As per Al Root; Source].

Ferrari roughly makes more than $80,000 per car sold, while other like Porsche makes an estimated $17,250 profit for every car, and BMW, Audi and Mercedes each make about $10,500 average per car [As per Jimmy Im; Source].

Conclusion

In our opinion, Ferrari's value and stock could continue to rise; not because of its sales but because the upper class and wealthy enjoy their elite status.

To learn more about relevant topics, check out https://7stocks.com/

Source: SubmitMyPR

Release ID: 12518