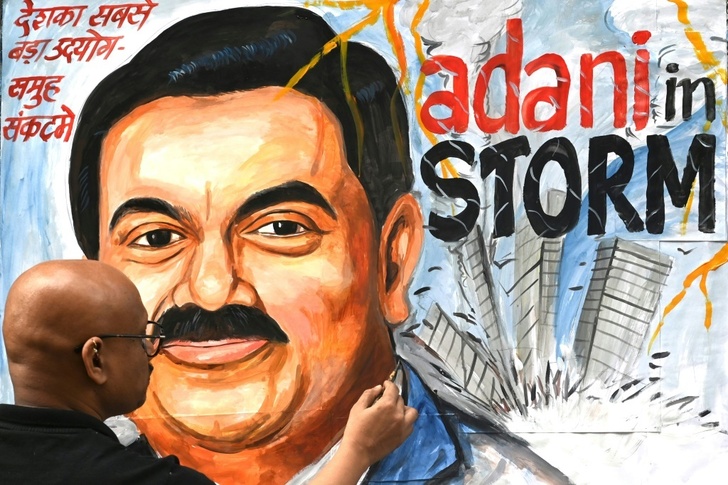

Shares in the flagship firm of troubled Indian conglomerate Adani rocketed as much as 20 percent Tuesday, making up some of the huge slump suffered since last month.

The group owned by tycoon Gautam Adani lost around $120 billion in value after claims of accounting fraud were levelled by short-seller US investment group Hindenburg Research on January 24.

The slide has raised concerns about the group's ability to raise fresh financing to pay down its debts. It cancelled a share sale, and reportedly also a bond issue, last week.

But Adani said Monday it was repaying early loans worth $1.1 billion, in a move meant to reassure investors.

Adani Enterprises, the group's flagship firm, soared on Tuesday, with trading suspended three times as they went up 20 percent.

They pared back some of the gains after transactions resumed, but were still up by around 15 percent in late morning trade.

Other group companies were mixed, with Adani Transmission and Adani Wilmar both limit-up five percent, and Adani Total Gas limit-down to the same extent.

Hindenburg accused Adani of "brazen stock manipulation and accounting fraud scheme" in "the largest con in corporate history".

Adani artificially boosted the share prices of its units by funnelling money into the stocks through offshore tax havens, the document said.

Adani benefited from what it called a "decades-long pattern" of government leniency, and that "investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal".

The company has rejected the claims as a "maliciously mischievous" reputational attack.

- 'Allegations are baseless' -

The loan repayment announcement came as The Economic Times newspaper reported that Britain's Standard Chartered had joined Swiss banking giant Credit Suisse and Citigroup in the United States in halting the acceptance of Adani bonds as collateral for loans it advances to private banking clients.

Last week Gautam Adani, 60, insisted that the "fundamentals of our company are very strong, our balance sheet is healthy and assets robust".

"These allegations are baseless," he told India Today television on Friday.

His personal wealth has more than halved, seeing him fall from number three in the Forbes real-time list of the richest people in the world to 17th as of Tuesday, with a fortune of $63 billion, down from $127 billion.

Critics say Adani's closeness with Prime Minister Narendra Modi, who is also from Gujarat state, allowed him to win contracts unfairly and to avoid proper oversight.

The publicity-shy school dropout saw his operations expand at breakneck speed, with Adani Enterprises shares soaring more than 1,000 percent over the past five years before the recent rout.

Analysts say the turmoil has hurt India's image just as it seeks to woo overseas investors away from China.

Commerce Minister Piyush Goyal on Saturday defended Indian regulators, saying they were "very competent".

Last week Adani cancelled a $2.5-billion stock sale meant to help reduce debt levels -- long a concern -- restore confidence and broaden its shareholder base.

The issue failed to attract "mom and dad" retail investors and only sold out thanks to large institutional buyers, fellow Indian moguls and $400 million from the United Arab Emirates' IHC.

stu/slb/dan

© Agence France-Presse

Your content is great. However, if any of the content contained herein violates any rights of yours, including those of copyright, please contact us immediately by e-mail at media[@]kissrpr.com.

Source: Story.KISSPR.com