UBS was up against the clock Sunday in talks to finalise a mammoth takeover of its troubled rival Swiss bank Credit Suisse and reassure investors before the markets reopen.

Switzerland's biggest bank UBS is being urged by the authorities to get a deal over the line, in a bid to avoid a wave of contagious panic on the markets Monday.

The wealthy Alpine nation's largest banks were in urgent negotiations this weekend with the country's banking and regulatory authorities, several media outlets reported.

The generally well-informed tabloid Blick said UBS will buy Credit Suisse in a deal to be sealed on Sunday during an exceptional meeting in Bern, bringing together the Swiss government and the banks' executives.

A merger of this scale, involving swallowing up all or part of a bank arousing growing investor unease, would normally take months. UBS will have had a few days.

However, the Swiss authorities felt they had no choice but to push UBS into overcoming its reluctance, due to the enormous pressure exerted by Switzerland's major economic and financial partners, fearing for their own financial centres, said Blick.

"Everything points to a Swiss solution this Sunday. And when the stock market opens on Monday, Credit Suisse could be a thing of the past," the newspaper said.

- 'Merger of the century' -

Credit Suisse, the country's SNB central bank and the Swiss financial watchdog FINMA all declined to comment when contacted by AFP about the possibility of a UBS takeover.

The Swiss government held an urgent meeting to discuss the situation late Saturday in the capital Bern. The government's spokesman refused to comment on the talks, Swiss news agency ATS reported.

An acquisition of this size is dauntingly complex.

UBS would require public guarantees to cover legal costs and potential losses, according to a report by Bloomberg, citing anonymous sources.

The SonntagsZeitung newspaper called it "the merger of the century".

"The unthinkable becomes true: Credit Suisse is about to be taken over by UBS," the weekly said.

The government, FINMA and the SNB "see no other option", it claimed.

"The pressure from abroad had become too great -- and the fear that the reeling Credit Suisse could trigger a global financial crisis," it said.

- Too big to fail? -

Like UBS, Credit Suisse is one of 30 banks around the world deemed to be Global Systemically Important Banks -- of such importance to the international banking system that they are deemed too big to fail.

"We are now awaiting a definitive and structural solution to the problems of this bank," French Finance Minister Bruno Le Maire told Le Parisien newspaper. "We remain extremely vigilant."

According to the Financial Times newspaper, Credit Suisse customers withdrew 10 billion Swiss francs ($10.8 billion) in deposits in a single day late last week -- a measure of how far trust in the bank has fallen.

After a turbulent week on the stock market, which forced the SNB to step in with a $54 billion lifeline, Credit Suisse was worth just over $8.7 billion by Friday evening -- precious little for a bank considered one of 30 key institutions worldwide.

FINMA and the SNB have said that Credit Suisse "meets the capital and liquidity requirements" imposed on such banks, but mistrust remains.

- Stock market plunge -

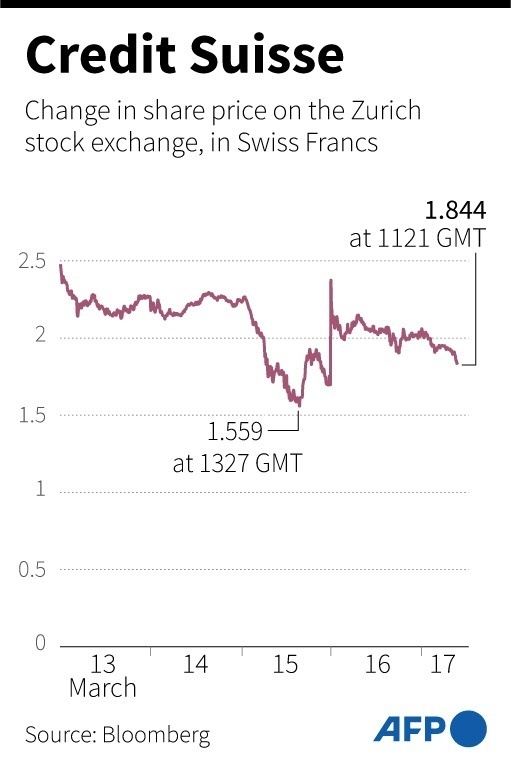

Amid fears of contagion after the collapse of two banks in the United States, Credit Suisse's share price plunged by more than 30 percent on Wednesday to a new record low of 1.55 Swiss francs.

After recovering some ground on Thursday, Credit Suisse shares closed down eight percent on Friday at 1.86 Swiss francs each as the Zurich-based lender struggled to retain investor confidence.

In 2022, the bank suffered a net loss of $7.9 billion, and expects a "substantial" pre-tax loss this year.

"This is a bank that never seems to get its house in order," IG analyst Chris Beauchamp commented in a market note this week.

The notion of Switzerland's biggest banks joining forces has cropped up over the years but has generally been dismissed due to competition issues and risks to the Swiss financial system's stability.

"The Credit Suisse management, even if forced to do so by the authorities, would only choose (this option) if they have no other solution," said David Benamou, chief investment officer of Paris-based Axiom Alternative Investments.

noo-vog-rjm/dhc

© Agence France-Presse

Your content is great. However, if any of the content contained herein violates any rights of yours, including those of copyright, please contact us immediately by e-mail at media[@]kissrpr.com.

Source: Story.KISSPR.com