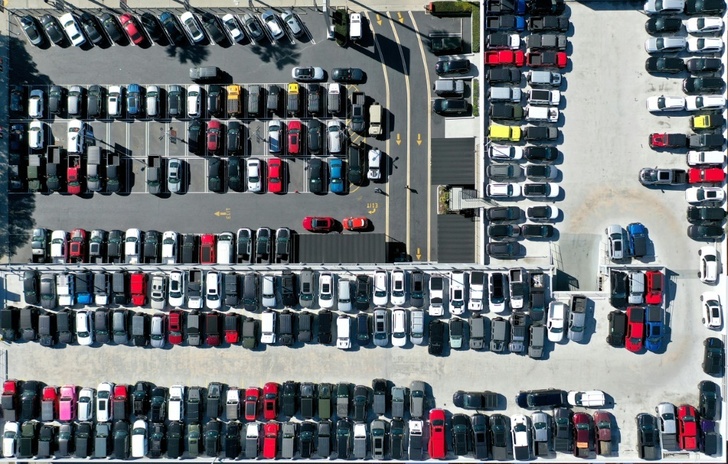

Retail sales in the United States returned to growth in April fueled by a rebound in motor vehicle sales, data released Tuesday showed, but not by as much as many expected.

The US Federal Reserve has hiked interest rates 10 times in a row since last year in a bid to suppress demand and slow inflation. The smaller increase in sales suggests the policy is having some impact.

Retail sales rose by 0.4 percent in April from a month earlier to $686.1 billion, the Commerce Department said in a statement, up from a revised decline of 0.7 percent in March.

The sales figure was half of the median expectation of economists surveyed by MarketWatch.

Sales were up 1.6 percent year-on-year.

"The April retail sales report shows consumers remain inclined to spend though they are becoming more selective in their purchases," Oxford Economics lead US economist Oren Klachkin wrote in a note to clients.

- Strong vehicle production -

A separate report released Tuesday by the Federal Reserve showed industrial production rose 0.5 percent month-on-month, beating median expectations of economists surveyed by MarketWatch.

Manufacturing output increased 1.0 percent, fueled by a strong gain in the output of motor vehicles and parts, the Fed said.

"Overall industrial production rose more than expected to start Q2 and the April level of factory output is higher than the Q1 average," Rubeela Farooqi, chief US economist at High Frequency Economics, wrote in a note to clients.

"Higher borrowing costs and weaker demand for goods are headwinds for manufacturing," she said.

But "a stabilization in demand at lower levels and a peak in interest rates coupled with onshoring and infrastructure spending could be positive for factory activity over coming months," she added.

- Inflationary pressures persist -

While the headline figure for retail sales came in lower than expected, the one excluding motor vehicle and parts dealers was in line with analysts' expectations, showing a small rise after two months of decline.

"While this is good news, inflation's persistent impact on consumers is apparent in the year-on-year comparisons with significant drops in discretionary categories" like home furnishings and electronics, Morning Consult's retail and e-commerce analyst Claire Tassin said in a statement.

Klachkin from Oxford Economics predicted the gathering economic "storm clouds" could lead retail sales to run out of steam before long.

"We expect a weaker labor market, depleted excess savings buffers, tighter credit standards, and high prices will make consumers less inclined to spend" in the second half of the year, he said.

da/mlm

© Agence France-Presse

Your content is great. However, if any of the content contained herein violates any rights of yours, including those of copyright, please contact us immediately by e-mail at media[@]kissrpr.com.

Source: Story.KISSPR.com