British telecoms group BT said Thursday it will axe up to 55,000 jobs by the end of the decade in the latest tech jobs cull in response to rampant inflation.

The layoffs, comprising 42 percent of BT's workforce, come two days after UK mobile phone giant Vodafone unveiled plans to cut 11,000 jobs or one tenth of staff over three years.

"Both have been struggling with the pressures of inflation, most notably from energy," said Victoria Scholar, an analyst at Interactive Investor.

BT employs 130,000 staff, including contractors.

The group will lower this to between 75,000 and 90,000 people over the next five to seven years, it said in a results statement.

The grim news follows the axing this year of tens of thousands of jobs across the global tech sector, including by Facebook parent Meta, as soaring inflation also saps the world economy.

BT is implementing further cutbacks, having already slashed costs under a plan launched three years ago.

"By the end of the 2020s, BT Group will rely on a much smaller workforce and a significantly reduced cost base," said chief executive Philip Jansen.

The company was "navigating an extraordinary macro-economic backdrop", he added.

The slimmed-down group "will be a leaner business with a brighter future" and will "digitise the way we work and simplify our structure".

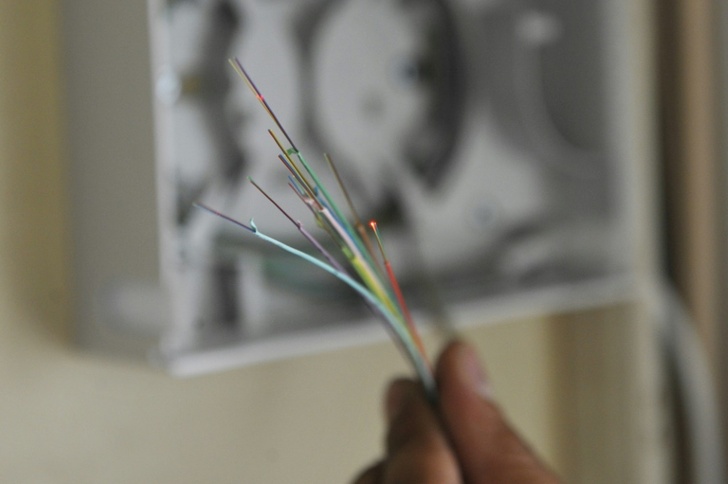

BT said that once its full fibre broadband and 5G network was rolled out, it would not need as many staff to build and maintain it.

The firm also revealed Thursday that net profit soared 50 percent to £1.9 billion ($2.4 billion) in its fiscal year to March, but the performance was skewed by a one-off tax credit.

Pre-tax profit sank 12 percent to £1.7 billion from a year earlier, while revenue dipped one percent to £20.7 billion.

- Shares slump -

Investors took flight following news of heavy cutbacks.

BT's share price sank almost nine percent in early morning deals on the rising London stock market.

It later stood at 138.95 pence, down 6.2 percent from Tuesday's close.

"Headlines will no doubt focus on the job cuts," noted Hargreaves Lansdown analyst Matt Britzman.

"It's drastic, but it's not overly surprising given the mounting costs and slim margins in the wider business."

As part of an ongoing overhaul, the firm announced a tie-up last year for its pay-TV channel BT Sport.

BT and Warner Bros. Discovery agreed to combine televised sport offerings in UK and Ireland.

The new joint venture, combining the assets of BT Sport and Eurosport UK, will launch later this year under the banner TNT Sports.

The move will mark the end of the BT Sport brand, which was launched ten years ago and features costly coverage of England's Premier League football.

"The consolidation has the potential to create synergies," noted Scholar.

Britzman said BT may be looking to eventually cash out.

"Likely the more important goal will be the slow disposal of the 50-percent stake BT holds in the joint venture; options are in place for Warner Bros to buy portions of BT's stake over the first four years," he told AFP.

rfj/bcp/rl

© Agence France-Presse

Your content is great. However, if any of the content contained herein violates any rights of yours, including those of copyright, please contact us immediately by e-mail at media[@]kissrpr.com.

Source: Story.KISSPR.com