Open decentralized communities in the form of blockchain networks are becoming increasingly attractive investment targets, but many crypto projects are already out of reach for the average investor.

When analyzing cryptocurrency projects, a detailed assessment of their economic model is required. Although this is only one of a number of important aspects to study, the underlying monetary principles determine the face of a startup, as well as its sustainability in the long term.

In 2024, the crypto market has seen a trend of launching tokens with low circulation volumes and high valuations at the start, with the project team and investors selling assets gradually over several years.

“Between 2024 and 2030, over $155 billion in crypto will be unlocked. Without increased demand from buyers and capital inflows, this amount of tokens entering the market will create enormous selling pressure,” according to the report by Binance Research.

Analysts note that in 2024, it is indeed difficult to find a project with reasonable economic metrics aimed at developing the project and creating gradual demand for ecosystem products. However, there are platforms where the long-term perspective is at the forefront of development planning. One of these is the Holiverse project.

Holichain (HC) Tokenomics

To understand the economic model of the Holichain (HC) token, it is necessary to conduct a brief dive into the Holiverse ecosystem. It is important to understand that Holiverse is a gamified metaverse, which consists of various business products and marketing tools. The HC token represents the link between them, seemingly uniting different elements into one integral economic space.

The starting point for analyzing the prospects of Holichain is the distribution of HC tokens and the process of their creation. #HC emission is strictly limited to a maximum amount of 422,375,579 tokens, but the embedded HC burning algorithms assume that the total number will only decrease over time.

This process is part of the deficit model, where the project periodically burns part of the circulating coins to maintain demand and improve inflation rates.

Holichain’s algorithms reduce the number of coins in circulation through staking and burning, optimizing the balance of supply and demand. There must be enough tokens for the network to function, but their excessive number should not create price pressure.

Just a few months ago, the company initiated a burn of about 28% of tokens, or $450 million (the price at the time of the burn), which were not mined as part of the multi-mining in the early stages.

Just over 52% of the tokens were distributed among early holders and participants of the Uniteverse program (the only way to mine HC), and 5% were allocated to user-holders of rating tokens (TR), who are developing the project’s partner network.

Separately, 8% were allocated for the listing stages and 1% for pools, probably decentralized exchanges. The team and grants received 2% and 4%, respectively.

Otherwise, the project has the following breakdown and activity in the blockchain: more than 5.3 million transactions and more than 102 thousand holders. Which is pretty good considering that the project has just announced its preparation for listing on centralized exchanges.

What is interesting here is the activity reflected on the #Polygon blockchain, where tens of thousands of transactions are made per day. Analysis of the products showed that these are quite reasonable transactions generated within the ecosystem.

At the time of writing, Holiverse has two main products: HoliDEX and Uniteverse. The first is a decentralized exchange based on its own developments, where HC is traded. The second is an economic strategic initiative, where the new Bitforce cryptocurrency is mined, which will become the main unit in the blockchain being developed within the Holiverse gaming metaverse. A number of other fundamental products aimed at creating a deficit of HC in the ecosystem are also under development.

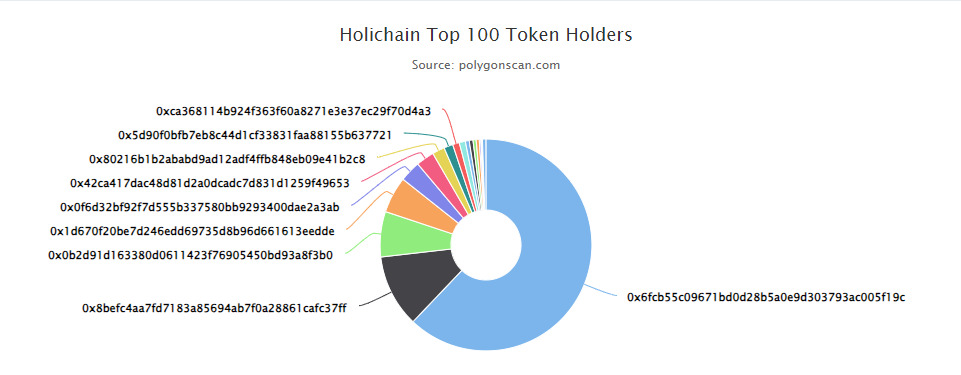

About 90% of tokens are at the TOP-10 addresses, which is due to the five-year token vesting program for early holders in order to reduce the speculative component and pressure on the price.

Deflationary mechanisms are needed for a smoother transition of the system to work on the global market without attracting outside investments. Holichain uses a community model of value distribution without the participation of venture capitalists and other participants who unfairly gained access to tokens at prices much lower than the market.

This distinguishes Holichain from many projects existing in the crypto market. Recent expert reports have shown that about 90% of tokens on the market reach trading with obviously poor tokenomics indicators. Most of the assets are allocated to the team and venture funds – they are the ones that have pushed the price down for several years.

About Holiverse

Holiverse is a metaverse that includes a set of marketing tools and algorithms for instant distribution of profits through smart contracts. The platform’s user base exceeds 2 million.

Media Contact Details:

Dan Michael

Holiverse press center

[email protected]

Disclaimer: The information provided in this press release is for general informational purposes only and should not be construed as financial or investment advice. The details regarding Holiverse and the Holichain (HC) token are subject to change and should be independently verified. Potential investors should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions. Holiverse and its affiliates are not responsible for any financial losses or damages incurred as a result of reliance on the information provided herein.

Original Source of the original story >> Why Lado Okhotnikov’s Token Holichain Grows in Price

Website of Source: https://holiverse.ai/news-portal

Source: Story.KISSPR.com

Release ID: 1225697