For many years, the world of venture capitalists, private equity firms, and real estate investment firms has operated under time-tested methods. The routine is comfortable, known, and predictable. But the financial landscape is shifting — technology's increasing role cannot be ignored. Known processes and activities are slowly becoming obsolete and ineffective.

Digital transformation isn’t just a trend, but a necessary step towards increased efficiency, safeguarding compliance, and improving investor relationships. While 74% of organizations consider digital transformation a top priority, some are still neutral or not at all confident in embracing this advancement. (Source: Exploding Topics, 2022)

Despite the known benefits, many private asset managers are resisting the advancement, with common fears related to cost, learning curves, and data security. The system is already complex, and adding new technologies into the mix may seem overwhelming. But consider this: Digitizing capital raise processes is emerging as an inevitable trend and is becoming less scary the more people come to understand what it means.

The New Reality of Capital Raise Processes

As the financial landscape evolves, so do the methods and tools of trade in the world of private investments. Gone are the days when capital raising required only a Rolodex and a phone. In today's highly competitive financial landscape, digital transformation is no longer optional— it's essential. A study by Statista shows that worldwide spending on digital transformation is expected to reach $2.51 trillion by 2024. By digitizing capital raise processes, firms can save time, reduce errors, and enhance the overall efficiency of their operations. (Source: Statistica, 2023)

- Increased Efficiency: Digitalizing capital-raise processes leads to automation of repetitive tasks, better time management, and reduced manual labor, resulting in an overall increase in efficiency.

- Enhanced Investor Experience: Digital platforms provide investors with a centralized location to access important information, communicate directly with fund managers, and monitor their investments, improving the overall investor experience.

- Better Regulatory Compliance: Digitalized processes make it easier to enforce compliance with financial regulations by automating checks, reporting, and documentation. This ultimately helps reduce the risk of non-compliance penalties and legal issues.

- Reduced Operational Costs: By automating certain processes, firms can potentially reduce costs in areas such as labor, printing, mailing, and storage, while ensuring efficient resource allocation.

- Improved Data Accuracy: Digital platforms reduce the scope for human error and inconsistencies in data, ensuring accurate and timely information flow across all stakeholders.

- Secure Data Storage and Exchange: Digital platforms provide secure, cloud-based data storage solutions that make it easy to access documents while ensuring data protection and meeting privacy regulations.

- Streamlined Communications: Digitalization simplifies communication with stakeholders (investors, partners, regulators), providing real-time updates and better tracking of conversations, leading to improved transparency and trust.

- Enhanced Analytical Capabilities: Digital platforms empower decision-makers with advanced analytics, reporting, and real-time monitoring, allowing for better strategic decision-making and risk management.

Digitalizing capital raise processes offers numerous benefits but how can you ensure that you unlock all of these with as few hurdles as possible? This is where WealthBlock comes in.

Embracing the Fear - The WealthBlock Solution

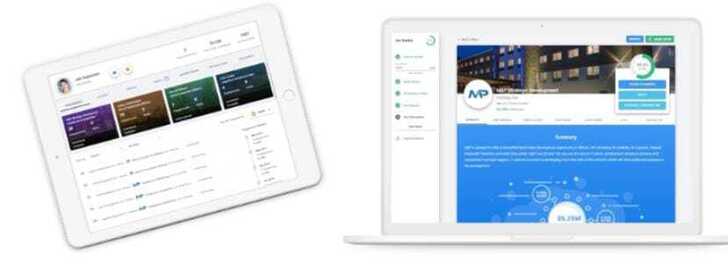

45% of executives don’t think their company has the right technology to implement a digital transformation (Source: Forbes, 2019). In comes WealthBlock, a platform that understands this fear. With its white-label capital raising and investor management platform, it creates a safe, efficient, and productive space for digitization to occur. Its standout feature? Streamlining workflows on one platform.

WealthBlock’s platform efficiency not only saves money but also improves productivity with the use of a unified system. So, how does WealthBlock do this?

1. Workflows Streamlined in One Platform

The traditional approach of juggling between different tools for CRM, data storage, investor engagement, report building, and transaction management is outdated. WealthBlock's easy-to-use and pleasing User Interface provides remarkable efficiency. Every feature – from CRM and Dataroom to Investor Journey Builder and Email Automation Builder – is built into the platform and accessible to the entire team.

2. Superior Tech Agility

The robust API and overarching tech agility offered by WealthBlock address concerns related to integration with existing systems and any custom needs that may arise. The platform is nimble enough to roll out product updates once every two weeks, ensuring that clients are always at the cutting edge of what's available.

3. Comprehensive Coverage

WealthBlock eliminates the need for multiple logins and stand-alone technology products. More than just a cost-saving measure, this reduces operational inefficiencies and lowers the risk of errors.

With superior setup time, easy-to-configure features, and an unparalleled user experience, WealthBlock stands out as a comprehensive solution that simplifies and accelerates the process of investor management and capital raising.

Embrace Change, Enjoy Results

Facing the fear is the first step to growth. A study by Gartner highlights that 56% of CEOs say digital improvements have led to increased revenue (Source: Gartner, 2017). Digitizing your capital raise processes isn't an intimidating task when you have a partner like WealthBlock.

By leveraging WealthBlock's efficient system, not only are you facing your fears head-on, but you are also welcoming a more streamlined operation, an improved investor experience, and ultimately, the opportunity for business growth.

To quote Nietzsche: "That which does not kill us makes us stronger." Digitization is simply a catalyst that will improve your firm's performance. It's time to turn your fears into action! See how WealthBlock can reshape the future of your capital raise processes, and why it's the change you'll wish you'd made sooner.

Visit WealthBlock today to learn more about how this innovation can benefit your operations. You can schedule a demo as well to see first-hand how WealthBlock can help you embrace digitization and face this new era head-on with confidence and peace of mind.

Source: Story.KISSPR.com

Release ID: 859875