We work hard through our lives, hoping to retire and live happily and peacefully once we are old. But will you have enough money to live the lifestyle we want?

We all want to spend our old age comfortably, doing what we missed doing when we were caught up with corporate jobs that did not allow us to spend enough time on ourselves.

However, many of us make the mistake of not planning ahead for our retirement, thinking that we will deal with it when it comes along. As a result, by the time you retire, you are unsure about what steps to take next, how to invest correctly to get the maximum returns and what you can do to live the retirement life that you always dreamt of. Worse still, you thought the pension or social security would supply enough to live a good life.

Experts say that the earlier you start planning your retirement, the better it will be. However, if you are decades or just years away from your retirement, it is never too late to start planning. Having a plan in place helps you prepare and be confident about living your retired life peacefully, knowing that you can handle it on your own.

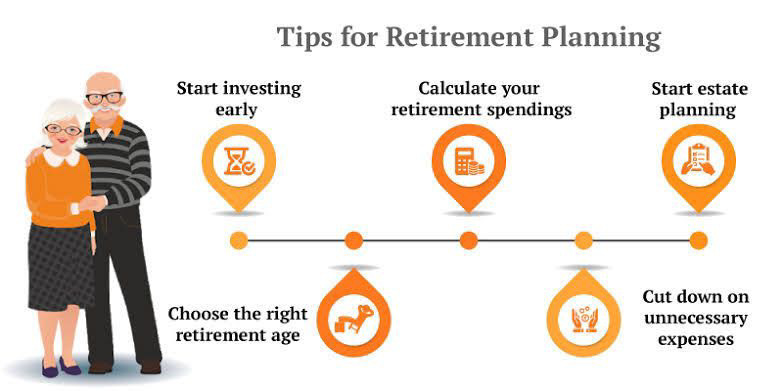

You may want to take professional and financial advice for planning your retirement or you may want to handle it on your own. Whichever way works for you, below is a list of five key points you must consider when planning your retirement.

1. Plan for Financial Security—Will You Be Able to Pay the Bills?

The most important thing to consider is the amount of money you will need to retire. While deciding the exact retirement age isn’t easy, running some numbers can help you understand how long you will need to budget for, and your expected expenses. You will need to consider the standard of living you want after you are retired and accordingly calculate the amount of money you would need to maintain that standard. Consider your current spending. Once you retire you would be spending around 70% - 85% of what your expenditure is now.

The next question that arises is where will these funds come from. Some sources may be your investments, your 401(k) plan, your savings and social security. Depending on how much money you will need to maintain the standard of living you have in mind post-retirement, you will have to start accumulating funds accordingly.

2. How Much Will You Need to Survive?

As mentioned above, you may be spending an amount closer to around 70% to 85% of your current income once you are retired. If you own your own home with no mortgage, your living expenses will be less than someone renting, for example. If you are looking at a retirement home you may need more.

While most of the daily expenses will be similar to the ones you have now, a major thing that needs to be considered is the medical expenses. With age, medical expenses automatically increase as you are more susceptible to health issues that come with old age.

While it is easy to control some aspects of medical expenses, there are many other factors that you need to consider. You will have to take measures to keep yourself healthy so that the chances of illness are reduced. At the same time, you will have to be careful with the Medicare plan that you and consider which kind of investment in a Medicare plan can yield the best results.

3. Effect on Social Security Benefits

As of 2024, you can start collecting your social security payments at the age of 60 or 62. However, it is always wise to have a strategy that will help you determine when would be the best time to begin collecting the social security payments.

Various factors can affect the social security benefits, right from something like your marital status, your plan to continue or not continue working post-retirement, and also the factor of whether or not you are eligible for government pension. One thing that applies to everyone is the longer you wait to start collecting social security benefits, the more you would receive.

4. Pay Off Your Debts

In today’s world, it is difficult to find a person who does not have any kind of debt. These debts can be in the form of student loans, mortgages, credit cards, or various loans. You don’t want to retire with debt, and should focus on clearing those debts that have a higher rate of interest first. Debts like credit cards, auto loans and personal loans have a much higher rate of interest than something like a home loan.

It is wise to prioritize and close these high-interest loans first as they will eat up your money. Also, paying off student loans, be it your own or your children's, is advisable as your social security benefits can be garnished by up to 15% if you are behind in paying off student loans. You must understand the implications of your debt on your retirement and have a plan in place to pay off these debts, hopefully long before retirement.

5. Setting Up Your Savings Plans

Organizing your savings is the most important thing to consider when planning your retirement. You can start investing in your 401(k) plan or your Individual Retirement Account (IRA) as soon as you can to reap the maximum benefit. Ensure that the amount of money you are allocating for investments helps you align with your retirement goals. If you have crossed the age of 50 you can also consider catch-up contributions. The closer you get to retiring, the more it becomes important to ensure that your savings are going to yield the right results.

Seek Professional Advice

It’s wise to take some kind of financial and investment advice from experts. If you have been investing by yourself for a long period and know how investments work, you will still benefit from taking some retirement planning advice from experts. If this is your first time, get some good basic advice from trained and qualified people who can keep your money safe, and grow your wealth for a comfortable retirement.

Website of Source: https://retirementguide.co.nz/

Source: Story.KISSPR.com

Release ID: 995545