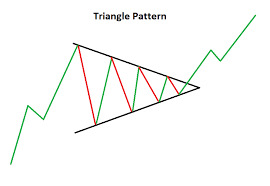

The triangle pattern is a type of price chart formation commonly observed in stock market analysis, typically manifesting during periods of market pause or consolidation. It is characterized by the gradual convergence of price highs and lows into a triangular shape.

Triangle Formation

Triangle formation is a notable price chart pattern in stock market analysis, often occurring during a pause or consolidation in market trends. This pattern emerges through the gradual convergence of price highs and lows, creating a triangular configuration. The formation of a triangle generally indicates a balance between supply and demand, reflecting caution among market participants. Throughout its formation, the price oscillates between a series of highs and lows, establishing significant trend lines and support/resistance levels. For more deteiled information, checking on Traderknows.

Types of Triangle Formations

Based on the direction of price movement and the geometric configuration of the triangle, three primary types of triangle formations are identified:

-

Ascending Triangle: This formation is characterized by rising price highs and relatively stable lows. It suggests increasing buying pressure and often precedes a breakout above the uptrend line, indicating a continuation of the upward trend.

-

Descending Triangle: This pattern features declining price lows while the highs remain relatively stable. It indicates increasing selling pressure and typically precedes a breakout below the downtrend line, signaling a continuation of the downward trend.

-

Symmetrical Triangle: In this formation, both price highs and lows converge symmetrically, forming a balanced triangle. It represents market indecision with balanced buying and selling forces. A breakout in either direction is needed to confirm the trend direction.

Significance of Triangle Breakout

The breakout from a triangle formation is a critical juncture for traders. A price breakout from the triangle's boundaries is usually accompanied by a significant increase in trading volume and noticeable price movements, providing a trading opportunity. However, the breakout direction is not always predictable; thus, traders must utilize additional technical analysis tools and consider market conditions to confirm trading signals.

Advantages and Disadvantages of Triangle Formation

Advantages

-

Market Pause or Consolidation Signal: The emergence of a triangle formation indicates a balance between buying and selling forces and market participants' caution, signaling market consolidation and aiding traders in decision-making during trend pauses.

-

Breakout Trading Opportunities: Price breakouts from the triangle's boundaries are typically accompanied by increased trading volume and significant price changes, presenting potential trading opportunities for traders to adopt appropriate buy or sell strategies based on the breakout direction.

-

Target Price Estimation: The height and width of the triangle can be used to estimate the target price area post-breakout, assisting traders in setting reasonable profit targets and stop-loss levels.

Disadvantages

-

Uncertainty in Trend Direction: Triangle formation does not explicitly indicate the direction of price movement. It reflects market uncertainty and potential breakout trends, necessitating the use of other technical indicators and analyses to confirm the trend direction.

-

Possibility of False Breakouts: Occasionally, prices may frequently break out of the triangle formation without the strength to continue the trend, leading to false breakouts and potential trade failures and losses.

-

Time Extension: The formation of a triangle can be time-consuming, requiring traders to wait for a breakout patiently. This may test traders' patience and require adjustments to trading strategies.

Trading Strategies for Triangle Formation

Triangle formation is applicable to various trading strategies, depending on traders' preferences and market conditions. Common strategies include:

-

Breakout Strategy: This involves waiting for the price to break out of the triangle's ascending or descending trendline, then opening positions to follow the trend. The breakout direction determines the trade direction, with stop-loss and take-profit levels set based on technical indicators or support/resistance levels.

-

Reversal Strategy: In some instances, triangle formation may signal a price reversal. Traders can wait for the price to break out of the triangle's trendline, then trade in the opposite direction of the current trend. This strategy requires caution and should be confirmed with other technical indicators and market signals.

-

Consolidation Strategy: Triangle formations often occur during market trend pauses or consolidations and can be used in consolidation strategies. Traders may adopt a wait-and-see approach during the triangle's formation, trading only after a breakout occurs to capture opportunities for trend resumption or continuation.

-

Pattern Combination Strategy: Traders can combine triangle formation with other chart patterns or technical indicators to develop a more comprehensive trading strategy. For instance, combining triangle formation with support/resistance levels, moving averages, and other indicators can confirm trading signals, plan further strategies, and manage risks.

Common Questions about Triangle Formation

How long does it take for a triangle formation to develop?

The time required for a triangle pattern formation to develop varies depending on the market and time frame. It can take several days, weeks, or even longer. Traders need to observe and confirm the formation according to the specific market and time cycle.

How to confirm the validity of a triangle breakout?

The validity of a triangle breakout can be confirmed through:

-

Price Range of the Breakout: A valid breakout is usually accompanied by significant price changes and increased trading volume.

-

Trading Volume of the Breakout: A valid breakout should be accompanied by a substantial increase in trading volume, indicating market participants' enthusiasm.

-

Continuation of the Trend Post-Breakout: The price trend should continue in the breakout direction, forming a strong trend.

How to determine the direction of a triangle breakout?

The breakout direction should be determined in conjunction with other technical indicators and market conditions. Generally, an ascending triangle breakout is a bullish signal, while a descending triangle breakout is bearish. Symmetrical triangle breakouts may not have a clear directional bias, and traders should wait for confirmation before trading.

How to set stop-loss and take-profit positions?

Stop-loss and take-profit positions should be based on individual risk preferences and trading plans. A common practice is to place the stop-loss on the opposite side of the breakout point to minimize losses. Take-profit positions can be determined using target price estimation, support/resistance levels, or other technical indicators.

What is the success rate of triangle formation?

The success rate of triangle formations depends on specific market conditions and the trader's technical analysis skills. The success rate is not fixed; traders should consider other factors for comprehensive analysis and decision-making while controlling risk and adhering to a trading plan.

Conclusion

The triangle pattern is a vital chart pattern in technical analysis, offering potential trading opportunities during periods of market pause or consolidation. While it provides valuable insights into market dynamics, it should be used in conjunction with other technical indicators and thorough market analysis to make informed trading decisions. Proper risk management strategies are essential for successful trading based on triangle formations. Consulting with a professional financial advisor is recommended for personalized advice and thorough technical analysis and risk assessment. What is more, searching more relatived information on Traderknows.

Contact Info

Website: traderknows.com

Email: [email protected]

Company: traderknows

Website of Source: traderknows.com

Source: Story.KISSPR.com

Release ID: 1061856